The cost of liquidating a company is sometimes prohibitive and directors who want to be proactive often can’t afford to take the necessary action to place a company into liquidation. That’s why from 1 January 2021 new legislation was put in place in an attempt to simplify the liquidation process to save time and money.

Surprisingly, recent ASIC statistics indicate that less than 1% of Creditors’ Voluntary Liquidations are utilising this process – so why not we ask?

What is a simplified liquidation?

The process for a simplified liquidation is where:

- creditors’ meetings are not held

- creditor committees are not formed

- liquidators need only to report to creditors within 3 months. No other mandatory reports are required

- reports need to detail the work performed, the likely finalisation date and whether a dividend is likely

- director offences are reported to ASIC.

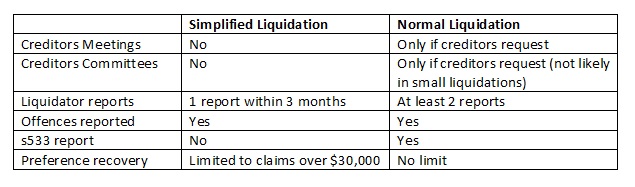

What are the differences between a simplified liquidation and a normal liquidation?

Looking at the above, the only real difference is a second report to creditors and a statutory report to ASIC. If it is a small liquidation, there is unlikely to be any more reporting to creditors anyway.

What are the issues with simplified liquidations?

Given some simplicity with the process, you may ask why is it not being utilised? We think the answer lies in the strict eligibility requirements, being:

- liabilities must be less than $1 million

- all tax lodgements and returns are required to be up to date

- the company is insolvent

- the report on company affairs must be lodged within 5 days by directors

- directors must declare that the eligibility criteria are met

- no director can have been a director of a company in the last 12 months that has had an external administrator appointed in the last 7 years and

- the company has not undergone a formal restructure in the past 7 years

From our long experience with SMEs and insolvency, we know that total liabilities are rarely less than $1 million, and that tax lodgements are rarely up to date. Consequently, very few insolvent companies meet all the required criteria for a simplified liquidation.

When you consider the strict reporting requirements on directors, coupled with the minimal cost savings between this process and a normal liquidation, it is easy to understand why it has not been more utilised.

This may raise issues for creditors to ponder if they are asked to support a simplified liquidation if one is proposed. The reasons are:

- it may result in lower fees; however, given the size of many of these matters, it is still unlikely to result in a better return to creditors

- it might mean reduced work for the liquidator, but that’s not a benefit directly to creditors if no dividend is expected anyway

- there is likely to be less investigation into directors’ conduct, but that may not suit the creditors

dVT Group’s opinion on simplified liquidations

Our opinion is that the simplified liquidation process is unlikely to result in significant cost or time savings, and therefore unlikely to result in any great benefits to creditors.

The reduced level of investigation and reporting may result in reduced transparency and lost opportunities for recoveries or reporting of director breaches. All of these factors may result in negative impacts on consumer confidence in the process.

Accordingly, dVT Group supports the continuing use of the standard Creditors’ Voluntary Liquidation process.

Should you wish to discuss the right solution for your business, please contact Suelen McCallum on 02 9633 3333 or mail@dvtgroup.com.au.

dVT Group is a business advisory firm that specialises in business strategy, turnaround, forensic investigations, and insolvency (both corporate and personal).